Proof of Source of Funds for Gold, Silver and Other Precious Metals

The anonymous purchase and sale of precious metals was last more strictly regulated on January 1, 2020. After precious metal lovers just came to terms with the new cash limit introduced at the time, a further restriction has now taken place. Learn in this article when you need to provide a proof of source of funds when dealing in gold, silver and other precious metals.

Why and When a Proof of Source of Funds for Gold and Other Precious Metals?

Precious metals such as gold and silver are becoming increasingly popular, and not just among Germans. They are mainly used for financial investment or asset protection. The legislator’s stance on this in Germany seems increasingly clear in light of recent developments.

Everyone is allowed to buy and sell gold, silver and other precious metals, but only reluctantly anonymously.

For the purpose of combating money laundering, the legislator severely restricted the so-called Tafelgeschäft at the beginning of 2020. This means buying and selling precious metals on site without establishing identity. After all, in online trading, you as a customer have to provide your personal data anyway.

First Lowered the Cash Limit, Now Proof of Origin of Funds Required for Precious Metals

On January 1, 2020, the legislator lowered the so-called cash limit for table business from EUR 10,000 to EUR 1,999.99 by tightening the German Money Laundering Act (“Geldwäschegesetz“, GwG). This applies regardless of where you want to buy or sell precious metals!

The term cash limit in this context is just as misleading as the term cash limit in connection with everyday cash payments. Because it suggests that above this amount no more precious metals can be bought or sold with cash. This is wrong, and so we’d best clear up this popular misunderstanding right away. Until now, the legal situation has been as follows:

In Germany, gold, silver and other precious metals can be purchased in any amount and paid for in cash. Since January 1, 2020, from EUR 1,999.99, only the identity card must be presented.

But what else has happened since January 2020?

As you may already know, stricter regulations around the GwG came into force on August 9, 2021. These also have an impact on the trade with precious metals within the framework of the table business. Under certain conditions, so-called proofs of source of funds have to be provided for your assets since the beginning of August. This concerns in particular, but not only, the area of cash payments.

News on Proof of Source of Wealth for Precious Metals

Cash transactions in connection with precious metals are now also affected. Under certain conditions, you must now prove that the cash for your precious metal purchase did not originate from criminal acts. The same applies to precious metals themselves that you wish to sell.

The wording of the provisions of the GwG in connection with cash deposits to the current account at your bank are already complicated. However, you need to take an even closer look at the regulations in connection with transactions involving precious metals.

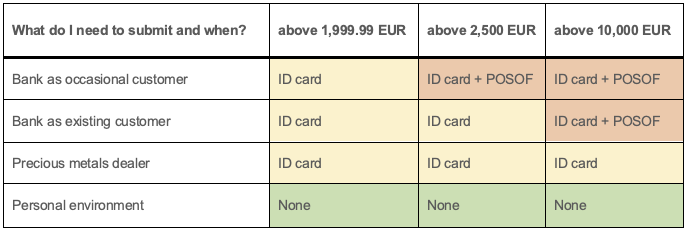

We take the result once in advance and describe the legal situation as it now looks since August 9, 2021:

In Germany, gold, silver and precious metals can be purchased in any amount and paid for in cash. From the limit of 1,999.99 EUR, the identity card must be presented for this purpose. From a purchase price of over 10,000 EUR, you must provide proof of source of funds for your cash if you buy the precious metals at your local bank. From over EUR 2,500, you must provide proof of source of funds if you buy from credit institutions that are not your house bank.

With the tightening of the GwG, which came into force on August 9, 2021, you must now provide proof of source of funds under the above-mentioned conditions. With the proof of source of funds you are supposed to plausibilize that the cash you want to pay with does not originate from criminal acts.

Difference Between Existing Business Relationship and Occasional Customers

So what is often misunderstood: Many, but not all, transactions involving precious metals and a cash payment over EUR 2,500 require the presentation of a proof of source of funds. The legal text of the GwG is very complex, differentiates between numerous different situations and parties involved and is therefore not infrequently misread.

Once the convoluted text is broken down, the following important key points emerge with regard to precious metals.

- The proof of source of funds applies to the purchase and sale of precious metals.

- Only credit institutions are obliged by the GwG to demand proof of source of funds. Independent precious metal dealers are not obliged to demand proofs of of source of funds!

- There are two thresholds for the purchase and sale of precious metals below which you do not have to provide a proof of source of funds: EUR 10,000 at your house bank and EUR 2,500 at credit institutions where you are not a customer.

Based on the two thresholds mentioned above, it is clear that the legislator uses the existence or non-existence of a business relationship between the buyer and the bank as the decisive factor. In doing so, it assumes that banks already have extensive information about existing customers and only imposes the obligation to require proof of origin of funds if the purchase price exceeds EUR 10,000. For so-called occasional customers who do not maintain an ongoing business relationship with the bank, the considerably lower threshold of EUR 2,500 applies. This is because occasional customers are strangers to the bank.

Legal Basis for Proof of Source of Funds vis-à-vis Banks for Gold, Silver and Other Precious Metals

Interestingly, not even the GwG itself reveals the now valid threshold of EUR 10,000 or EUR 2,500 for cash purchases of precious metals without proof of source of funds.

Rather, the application and interpretation notes to the GwG formulated by the Federal Financial Supervisory Authority (“Bundesanstalt für Finanzdienstleistungsaufsicht“, BaFin) especially for credit institutions determine these so important thresholds. We have provided a link to these notes in our FAQ in one of the first questions.

That the thresholds are intended to apply only to credit institutions is clear from an introductory note in the document:

“These interpretation and application notes refer to the GwG as amended on January 15, 2021, and apply to obligated parties pursuant to Section 2 (1) No. 1 GwG. (…)”

Obligated persons pursuant to Section 2 (1) No. 1 GwG are credit institutions.

BaFin then makes the following statement in its instructions for transactions outside of a business relationship (occasional customers):

“In the case of cash transactions carried out by credit institutions outside of a business relationship with so-called occasional customers, and which exceed an amount of 2,500 euros, an increased risk (…) is to be determined in principle.”

For transactions within a business relationship, it then states:

“In the case of cash transactions carried out by credit institutions within a business relationship (…) and exceeding an amount of 10,000 euros, the source of the assets must in principle be proven by means of meaningful supporting documents. (…)”

No Proof of Origin of Funds for Independent Precious Metals Dealers?

As a result of this regulatory system, the low threshold of EUR 2,500 for the presentation of proof of source of wealth for cash purchases of precious metals only applies to occasional customers.

If there is an increased risk (see above) for money laundering, so-called enhanced due diligence obligations must be observed and implemented by the person obligated by the GwG. Obligees in the sense of the GwG are all places, at which precious metals can be acquired, with exception of private people.

So if you want to purchase precious metals over 10,000 EUR or 2,500 EUR at banks and pay in cash, they must observe and implement the enhanced due diligence requirements of the GwG. In order to fulfill these due diligence obligations, obligated parties are required, among other things,

“(…) take reasonable measures to determine the source of the assets used in the business relationship or transaction (…).”

These measures then usually consist of requiring proof of source of funds for the cash with which you wish to pay for the precious metals.

Exempted from the obligation to demand proof of source of funds are currently in principle still free dealers in precious metals. These are only obliged to demand such proofs in special exceptional situations. At least this is how the wording of the GwG and the associated instructions of BaFin (as of August 2021) reads.

For the time being, therefore, free traders will generally remain subject to the regulations that have been in force since January 2020. These provide for an identification requirement for cash purchases of EUR 2,000 or more. Independent dealers only have to require proof of source of funds if the payment is unusually large, for example. This is likely to be a question of the individual case.

Overview of Proof of Source of Funds (POSOF) for Gold, Silver and Other Precious Metals in Germany

Outlook for Further Developments on the Proof of Source of Funds for Gold and Other Precious Metals

All in all, it becomes clear that the legislator will further restrict the table business with precious metals after the lowering of the cash limit in January 2020 now in August 2021 by requiring a proof of source of funds. In this context, the meaningfulness of a cash limit of EUR 1,999.99 for purchases without proof of identity (ID card) and a threshold value for purchases without proof of source of funds of EUR 2,500 (for occasional customers) may be questioned.

The remaining difference of around EUR 500, in which cash purchases of precious metals may still be made “only” with identification but without proof of source of funds of the financial resources, is conspicuously small. This may be a sign that a further lowering of the cash limit for purchases without proof of identity from EUR 1,999.99 to perhaps EUR 999.99 is only a matter of time.

Furthermore, the proof of source for precious metals is a prime example of how easy it is for legislators to introduce a proof of source of funds requirement for purchases of certain groups of goods. The legislative means are there and the adjustment effort is low.

As shown above, it is not even necessary for the legislature itself to take action. It is sufficient if an authority assumes an increased risk of money laundering for a group of goods. Due to the systematics of the GwG, this simultaneously introduces increased due diligence requirements of the GwG into the respective transactions. This can also be done with any other goods and threshold values.

Refusal and Evasion of Proof of Source of Wealth for Precious Metals?

In principle, you can refuse to submit the proof of origin of funds altogether. However, in practical terms, this means that you will not be able to successfully carry out your planned purchase of precious metals.

This is because if the credit institution does not receive the proof of the source of your funds from you, it will refuse to conclude the contract. The same applies if it considers the proof provided to be insufficient.

There is also the risk that your gold, silver, etc. will initially be “frozen”, i.e. retained. This applies, for example, to constellations in which you order precious metals to a branch and want to pay cash there. However, there are far more complicated examples.

It is not yet clear to us to what extent the withholding of euro balances, precious metals or other assets is permissible in this context. This is because Section 246 (2) of the German Criminal Code (“Strafgesetzbuch“, StGB) stipulates that the unlawful retention of another person’s property is punishable by law. The Money Laundering Act and the associated European directives and regulations do not make any explicit reference to this fact.

A “circumvention” of the proof of source of precious metals, however, is possible in a completely legal way and without consequences. By acquiring the precious metals for example – as described above – at your house bank (up to 10,000 EUR purchase price) or in the private sphere.

If you purchase your gold, silver and other precious metals in the private circle of family members, friends or acquaintances, no proof of source of funds is required. This is because private circles are not among the entities that must obtain proof of the source of the financial resources.

No Proof of Source of Funds for Collector’s Items Such as Rare Gold Coins?

The question of what exactly the legislator means with regard to gold, silver and precious metals when it comes to proof of source of wealth is an exciting one. Many initially think of gold bars, larger “silver mountains” and other precious metals clearly acquired as investment objects.

However, what applies with respect to collectibles that are made of gold, silver or other precious metals? Are these particular items also equally affected by the proof of source of funds?

We raise this question because in the previous, historical gold bans, it was predominantly rare collectibles that were explicitly exempted from the gold ban. For those affected by the gold ban, this meant that while larger quantities of gold that clearly served to secure assets now had to be left more to the state – valuable collector’s items made of gold, on the other hand, did not.

In concrete terms, therefore, the question must be asked whether the legislature may treat all gold items equally without distinction. Is a simple 1 oz gold coin, such as is minted millions of times a year, simply comparable to a strictly limited special edition gold coin?

One is an investment item, the other a collector’s item.

Legislators under the rule of law may not “just like that” regulate a material per se, but must also take into account special manifestations of the material in the form of certain collector items.

Therefore, it may be that your rare, strictly limited collector gold coin would not be affected by the proof of means in the same way as, say, your investment gold coins such as the Krugerrand.

What to Do If I Have No Proof of Source of Wealth for My Gold (Anymore)?

As already described, the proof of source of funds can be required for the transaction value of more than EUR 2,500 not only for cash (when buying), but also for precious metals themselves (when selling). The GwG does not exclusively target cash, but any form of asset.

In other words: If you want to sell precious metals worth more than EUR 2,500 at a dealer, you must be able to prove the legitimate source of these precious metals!

In principle, it is not forbidden to purchase or sell gold, for example, without proof (within the valid limits). The only question is whether you will ever be able to resell this gold at an “official place” without the corresponding proofs. Possibly your proof of source of your gold, silver or other precious metal fails simply because you have no proof (anymore).

This may be due to the fact that you once bought these investment objects “somewhere” ages ago and possibly do not even know where and at what price. Or you may still know the details of the purchase, but there are no records of it.

In Case of Doubt Presumption of Innocence Regarding Proof of Origin of Funds for Gold and Other Precious Metals

For the individual questions regarding evidence in the case of proof of source of funds, please read the detailed page under the above link. We already point out here the possibility of witness statements as proof. Surely you do not share your purchases and sales of gold, silver and precious metals with every neighbor. Presumably, however, your closest friends, family members or life companions can testify to the transactions.

Incidentally, the presumption of innocence applies in legal proceedings. The competent court will take an overall view of your financial circumstances. If there are no indications of money laundering or terrorist financing on your part and the sum in question fits “coherently” into your financial life, this is positive evidence. In case of doubt, a court is then likely to assume that you acquired or sold the precious metals lawfully.

Questions and answers

Who is asking me for a proof of source of funds for gold?

Credit institutions with which you are not yet a customer, for cash purchases and sales from 2,500 EUR. Credit institutions with which you are already a customer, for cash purchases and sales from 10,000 EUR. The tax office may also ask a question about the origin of your financial resources.

How can I provide proof of source of funds for precious metals?

By proving the source of the gold, silver and other precious metals in a court of law. For this purpose, various means of evidence are available to you. Find more information on our page about evidence.

I no longer have any proof of source of funds for my gold, what should I do?

You may not have any written evidence, but there is also evidence that has nothing to do with documents that would have to be presented. Feel free to take a look at our section on evidence.

- Published: November 20, 2021

- Latest Update: March 24, 2022