Proof of Source of Funds for Bitcoin

Owners of Bitcoin, Ethereum and other cryptocurrencies must now also provide proof of source of funds in numerous cases. For while younger people in particular have recognized cryptocurrencies as an opportunity for investment in recent years, EU lawmakers were already fine-tuning stricter regulations for crypto trading.

The blockchain sector, still weakly regulated to this day, has recently been in a state of flux. Not only the pressure on crypto exchanges, brokers and service providers in the field of cryptocurrencies is growing. States are concerned about lost tax revenues of considerable proportions. They are now also taking private individuals more seriously when it comes to crypto trading.

Other common words for proof of source of funds:

- origin of wealth

- proof of funds

- source of wealth declaration

- origin of funds

- source of funds

Why a Proof of Source of Funds for Bitcoin?

With the so-called proof of source of funds, you prove that your assets such as Bitcoin, cash or precious metals have a legitimate origin and, in particular, do not represent profits from criminal acts. Within the scope of this proof requirement, it is about the plausibility of the origin of your wealth vis-à-vis the demanding body. The documents and other evidence that can be considered for this purpose are described in more detail on our Evidence page.

Since the extension of the obligation to provide evidence in Germany in August 2021, media reports have been very one-sided. It was mainly about the cases in which a proof of source of funds has to be presented to the bank for cash deposits to the current account or for trading in precious metals.

In order to be able to classify this reporting correctly, you should clearly differentiate the discussion about the proof of origin of funds from the reports about so-called cash limits. The issues are only indirectly related.

The fact that media primarily reported on the context to banks quickly makes you forget that the proof of source of funds applies to numerous other assets than cash!

When Do I Have to Provide a Proof of Source of Funds for Bitcoin?

Bitcoin, in particular, is an asset that has gained crucial importance in recent years. However, proof of source of wealth (origin of funds) can equally be required for Bitcoin. This applies more and more to Ethereum as well.

Admittedly, these cryptocurrencies have hardly been mentioned in the related media coverage. Nevertheless, the problems of Bitcoin owners in connection with the proof of source of funds are increasing.

The reason for this is the tightening of legislation, which initially took place at the EU level, but has now also been reflected in the laws of the EU member states.

Origin of funds concerning crypto currencies!

When a proof of source of funds for Bitcoin and other cryptocurrencies is required from you cannot be said in a blanket manner. This is because this depends significantly on the following factors in particular:

- What do you want to do with your Bitcoins?

- Between which parties should the Bitcoins be transferred?

- What is the monetary equivalent value of the Bitcoins in question?

- According to which legal situation must your transaction partner comply?

As a general rule, you do not have to provide proof of source of funds for Bitcoin, Ethereum and other Coins, at any rate, if you conclude a transaction between private individuals and transfer the cryptocurrencies from private to private. Here, we assume the legal situation in the EU member states. However, even beyond that, we are not aware of any jurisdiction that imposes such proof of source of wealth requirements for private transactions.

Who is asking for source of funds with Bitcoin?

Declaration of wealth or source of funds for Bitcoin is generally only required from you if commercial service providers (e.g. exchanges, brokers or other trading venues) are involved. Indeed, these now have to comply with increasingly stringent domestic or foreign laws that require them to enforce such proof of funds requirements on their customers.

On our page on proof of source for cryptocurrencies, we have presented concrete examples of how individual crypto exchanges from different countries and continents handle proof of funds obligations differently.

In order to avoid triggering the proof requirement for every transaction, the relevant exchanges make use of certain monetary limits / thresholds, above which customers are required to provide proof of source of funds.

Often, brokers, exchanges and trading venues have discretionary powers in this regard as part of their own risk management and risk analysis. They can set the thresholds themselves within a framework and usually do not disclose them in order to prevent evasion of the obligation to provide evidence.

Bitcoin and Other Cryptocurrencies in the Focus of the Fight Against Money Laundering

With the so-called “AML5 Directive“, the fifth EU Anti-Money Laundering Directive, the EU legislator focused for the first time also on the explicit inclusion of cryptocurrencies in the scope of anti-money laundering regulations. We have compiled these and other directives as well as laws for you in the FAQ section under “Legal basis“.

There are certain reasons why cryptocurrencies have been targeted by international lawmakers in recent years:

- Concern about tax evasion.

- Combating the misuse of cryptocurrencies for criminal purposes.

- Hidden origin of wealth and source of funds transactions.

Since the emergence of Bitcoin as the first cryptocurrency in 2009, the entire cryptocurrency space has been in largely unregulated territory.

It was not until 2020 that voices from the international political arena began to be increasingly heard calling for the necessary regulation of cryptocurrencies. The reason for this is obvious. Bitcoin, but also numerous other cryptocurrencies, experienced the beginning of a bull market at that time, which culminated at the end of the first quarter of 2021.

EU Lawmakers See Potential for Abuse in Cryptocurrencies

During this period, numerous crypto investors made significant capital gains. However, taxing these asset gains – or rather, monitoring compliance with tax obligations – was challenging for states.

This is because, from the legislative side, Bitcoin and other cryptocurrencies had not been dealt with for a long time. The soaring value and now high popularity of many cryptocurrencies now made it possible to move large assets around unobtrusively.

Coupled with the concern about lost tax revenues of considerable magnitude was, from the perspective of numerous states, an increasing danger that criminals would find real opportunities to stash illicit assets in the now valuable cryptocurrencies.

The following statements in the above-mentioned fifth EU Money Laundering Directive illustrate the political concern about the misuse of cryptocurrencies such as Bitcoin and others, which are referred to there as “virtual currencies“:

AML and origin of funds (source of funds) with Bitcoin

The above-mentioned Directive as well as the “AML6 Directive” that followed it have already been implemented by the EU Member States into their respective applicable national laws. With regard to the legal situation in Germany, particular mention should be made of the Money Laundering Act (“Geldwäschegesetz“, GwG) and the interpretative and instructional notes (“Auslegungs- und Anweisungshinweise“, AuA) on the Money Laundering Act regularly provided by the Federal Banking Supervisory Authority (“Bundesanstalt für Bankdienstleistungsaufsicht“, BaFin) (links in the FAQ section under “Legal Basis”).

We have also taken a closer look at the Austrian “Finanzmarkt-Geldwäschegesetz” (FM-GwG) on our page on the legal situation in Austria.

Special Rules in Proof of Source of Funds Specifically for Bitcoin?

Bitcoin and Ethereum are by far the most valuable cryptocurrencies on the market, measured by the equivalent value of a coin in money. However, oriented to the legal situation of the EU member states, there is no special treatment in the proof of origin of Bitcoin and Ethereum. This is because the regulations focus on assets related to cryptocurrencies in general, not on individual coins.

Nonetheless, the two cryptos mentioned above in particular could be subject to proof of source of funds much more frequently than others. This has to do with the high price value of the two cryptocurrencies.

As shown in the upper part of this page, crypto exchanges, brokers and other trading venues work with limits or thresholds when it comes to the question of whether proof of funds should be required or not.

These are partly at the discretion of the service provider and cannot be quantified across the board. However, experience shows that transactions of cryptocurrencies with an equivalent value of EUR 10,000 trigger the exceeding of these limits in any case. At the current price of Bitcoin, it is obvious that even the transaction of one Bitcoin exceeds the threshold by far.

No Proof of Source of Funds for Bitcoin by Circumvention? Better Not!

For many, the question may now arise whether this case does not actually only concern rich people who can afford whole Bitcoins.

The answer is “Yes and no.”

For one thing, cryptocurrencies basically do not have to be traded “as a whole”, but only 0.1 or even less can be acquired. So, the transferred Bitcoin part can also be significantly below a threshold of 10,000 EUR.

On the other hand, however, it should not be underestimated that there are now a significant number of people who own substantial assets in Bitcoin. This applies in particular to those investors who acquired Bitcoin (or indeed Ethereum) many years ago at a very low price.

It is true that even the owners of larger amounts of Bitcoin can only transfer small portions of their coins. However, by doing so, they trigger circumvention events faster than they would like, which lead to suspicious activity reports from the crypto exchange to the regulatory authorities!

On our page on cash, we described that circumventing the proof of source of wealth by so-called smurfing or structuring is not allowed and is very well known to regulators. Nothing else applies to the proof of source of Bitcoin and other cryptocurrencies.

Important Questions and Answers Bbout the Proof of Source of Funds for Bitcoin

Does the source of funds for Bitcoin apply in the same way regarding other cryptos?

Yes, in terms of the origin of financial resources, there is no difference between Bitcoin or other cryptocurrencies.

What about verification requirements on different crypto exchanges?

The exchanges where you can trade Bitcoin and cryptocurrencies handle proof of funds differently. You can find our information pages on Bitpanda, Binance and Kraken here:

Proof of source of funds at Kraken

Origin of funds at Coinbase

Proof of funds at Bitpanda

Source of wealth at Binance

Proof of source of funds at Bitstamp

Difficulties arise due to the fact that crypto exchanges are domiciled in different jurisdictions. Therefore, the same legal situation regarding proof of origin for Bitcoin and other cryptocurrencies does not apply everywhere.

Are my pay stubs enough proof?

Mostly not, because your pay stub in itself cannot be used to determine whether or not Bitcoin was purchased with those funds.

Therefore, the proof of origin of funds in Bitcoin refers to several proofs - your payslip can be a part of the proof of origin.

What about gifting with bitcoin?

If you received your Bitcoins as a gift, there is a gift agreement - this can be cited as proof of origin.

Please note that the statement "I got the Bitcoin as a gift from a buddy" will probably not be sufficient.

How do I prove that a Bitcoin address belongs to me?

The proof that an address "belongs to you" can be implemented technically. There is the possibility to sign a message in the Bitcoin system (by means of the private key).

However, by having an address on the Bitcoin blockchain that is assigned to you, you cannot provide proof of means.

At best, the address proves that you can dispose of the address (the private key). It does not prove where the Bitcoins on this address come from.

How can I get around the proof of funds requirement with Bitcoin?

With the largest crypto exchanges, it will hardly be possible to circumvent the proof of source of funds. However, it is permitted to buy or sell Bitcoin from private to private in a direct manner - i.e. without using an exchange.

In most cases, you do not have to provide proof of source of funds to private buyers or sellers. However, we cannot advise this method. If you buy or sell Bitcoin "quasi anonymously", you will always lack important proof in the end. Sooner or later, this is likely to lead to disadvantages.

However, if you attach great importance to owning cryptocurrencies as unmolested as possible, you can choose this path.

Special Knowledge: Satoshi Nakamoto Would Succeed in Proving the Origin of Funds at Any Time!

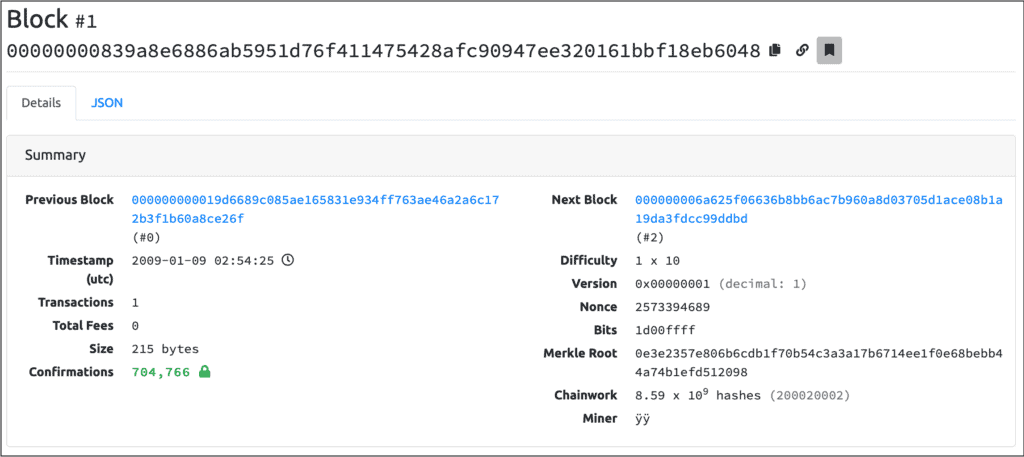

The example of Satoshi Nakamoto, the inventor of Bitcoin, can be used to illustrate the proof of means for cryptocurrencies. Imagine how Satoshi Nakamoto “put Bitcoin online” for the first time. In doing so, Satoshi Nakamoto had to do his own mining, i.e., create blocks in the blockchain – because there were no other miners except for himself.

Thus, Satoshi Nakamoto is not only the inventor of Bitcoin, but also the one who, in his own person, can at any time perfectly prove his very first transactions in Bitcoin with regard to their origin.

Starting from Satoshi, a “chain of funds provenance” is created on the blockchain. In essence, Satoshi Nakamoto has the ultimate proof of source of his Bitcoins. All other proofs of source of Bitcoin ultimately point back to Satoshi Nakamoto’s very first transaction (albeit over countless individual transactions over the past 10 years).

However, “Satoshi Nakamoto” is a pseudonym and not the real name of the inventor of Bitcoin. In order to comply with the obligation to provide proof, the person behind this world-famous pseudonym would have to be able to prove his identity in a court proceeding. It remains to be seen when Satoshi Nakamoto will appear under his real name.

Mining in Bitcoin As a Way to Prove the Source of Funds?

Using Satoshi Nakamoto as an example, it is easy to see that Bitcoin mining is a “clean way” to meet the proof requirement. The origin of funds in mining is clear: mining has created new Bitcoins. Therefore, the successful mining activity itself is the proof of source of Bitcoin.

But how does one prove that one has obtained this or that Bitcoin by mining itself? Firstly, by means of the blockchain, which shows which miner (more precisely: which Bitcoin node) receives which Bitcoins as a reward for the mining activity. Secondly, by the miner proving its own hardware and software.

Miners today are not “hobby” miners, but multi-million and even multi-billion dollar companies. In this regard, there is no longer “anonymous mining” in Bitcoin.

However, those who mined on a hobby level in the early stages of Bitcoin sometimes find it difficult to obtain court-proof evidence of their own mining activities. Here, it is particularly important to be able to properly present the hardware and software used at the time.

If this evidence is missing, it will also be difficult to prove the source of the wealth. However, there are almost always “traces” of mining. A large amount of evidence can be recovered in the vast majority of cases with professional support.

Because the fact is: if you received your Bitcoin through mining, your mining is the proof of means. It is then simply a matter of convincingly citing your own mining as proof of source.

General Challenge With Proof of Source of Funds for Bitcoin Owners

We can provide you with numerous tips on how to provide proof of source of Bitcoin and other cryptocurrencies in a legally secure manner. Crypto exchanges and brokers also formulate specific expectations for the required proof. They also specifically name documents that you should submit.

However, numerous cryptocurrency owners face a very basic problem in providing proof of source of funds:

At the time they acquired their coins or received them as a gift, no one thought of the need to prove the origin of these coins once!

Even though the proof of source of funds has been present at exchanges and brokers for several months now and numerous proofs are required. In the history of cryptocurrencies, the proof of source of wealth is virtually a novelty. Even the vast majority of the media do not report on the connection with cryptocurrencies despite the recent significant tightening of the legal situation. The resulting lack of information for those affected further complicates the situation.

In the early years of Bitcoin, no one believed that cryptocurrencies had any significant value. Cryptos were considered a gimmick for “nerds.” Bitcoins were initially purchased for a few cents or euros and given away at will. It was paid with them among friends for fun. Then, in 2021, we saw price values of over EUR 50,000 per Bitcoin.

For many, this meant a massive increase in wealth. However, those who want to monetize their Bitcoins on earlier days today and realize their profits with them can run into a problem as far as providing proof of source of Bitcoin is concerned. This is because any sale of Bitcoin and other cryptocurrencies to receive money for it will usually have to go through a crypto exchange or broker.

Unless you have private buyers paying you money for your cryptocurrencies. They do not have to require you to provide proof of funds.

Proof of Source of Funds for Bitcoin can Threaten Own Assets!

In particular, persons who would like to convert substantial holdings of Bitcoins from previous years into money should carefully consider the procedure in view of the now applicable proof of source of funds requirements for the Bitcoins. Keep in mind that the current money laundering regulations virtually place the persons concerned under a general suspicion of money laundering once certain thresholds are exceeded!

We would like to sensitize you to the fact that the moment you transfer your Bitcoins or other cryptocurrencies into the wallet of a crypto exchange or broker for the purpose of selling them, you are exposed to the measures of these service providers!

So consider beforehand (!) whether you can satisfy possible proof obligations and provide proof of source of Bitcoin. Why before? As described several times on our site, numerous exchanges proceed to freeze your assets (both cryptocurrencies and fiat money) on the customer account the moment a proof of source of funds is required from you.

The account will only be unfrozen once you provide proof of the source of your money or coins that is sufficient in the eyes of the exchange. It should be obvious that this situation (depending on the amount of your assets) can become downright unpleasant. Especially if you have difficulty providing proof of funds due to the situations outlined above.

So first develop a strategy for how your proof of source of your Bitcoins can succeed. If necessary, help yourself to professional assistance. Because even if you do not have any proof documents from before. The source of your coins can often still be proven with sufficient professional and technical know-how!

No Obligation to Present Proof of Source for Funds for Bitcoin!

Finally, we would like to clarify one thing: You are under no obligation to exchanges or banks to provide proof of source of your Bitcoins or other cryptocurrencies.

Even if the tax office requires a proof of source of funds, there is no “compulsion” in the true sense. In principle, you are not required to disclose the source of your financial resources.

The question, however, is how your refusal to provide proof of the source of funds with respect to your Bitcoin holdings will ultimately play out. In relation to crypto exchanges and banks, a refusal to provide proof would result in you no longer being able to trade there or your current account being blocked. If the tax office does not receive the required proof of source of funds from you, administrative measures may be taken.

In practical terms, therefore, failure to provide proof of source of funds for Bitcoin and other cryptocurrencies effectively excludes you from being able to exchange your Bitcoins and other cryptos for euros or dollars without any complications. In this respect, it is true that there is no “obligation to provide proof of funds” with Bitcoin. However, from a pragmatic point of view, it is advisable to comply with the obligation to provide proof accordingly.

- Published: November 20, 2021

- Latest Update: August 31, 2022