The Proof of Source of Funds for Cryptos

The proof of source of funds for cryptocurrencies is causing uncertainty. How the obligation to provide proof regarding Bitcoin and other cryptos is to be fulfilled is not clear to many affected parties. Already the question why also a proof of source of funds for cryptocurrencies, and not only for fiat money has to be submitted, is difficult to answer.

Also the explanations of the requesting bodies, such as exchanges, brokers or trading platforms dealing with Bitcoin and cryptocurrencies, often do not help. Here, the “worst case” is that the provided proof of source for the financial resources is rejected.

Credit balances and cryptocurrencies can then be blocked entirely on the affected account. You should avoid this at all costs. It is therefore worthwhile to do a little research on the proof of source of funds for cryptocurrencies – this way you can relax in the future and comply with the obligation to provide proof.

Why Do Many Now Want Proof of Source of Funds for Their Cryptocurrencies?

The obligation to disclose the source of certain assets to banks, brokers, stock exchanges and numerous other bodies has been in the media since the beginning of August 2021. And that’s not even talking about the discussions about a Europe-wide asset register, which are currently also taking place in parallel.

As you can read in more detail on our page on the tightening of proof requirements in Germany, the latest amendments to the Money Laundering Act (“Geldwäschegesetz“, GwG) have greatly expanded your obligations to prove the legitimate source of your assets. This adaptation of anti-money laundering laws is currently taking place in all EU member states. This is no coincidence. After all, the specifications for the tightening come from recently stricter EU directives. These are intended to advance the member states’ joint fight against money laundering and terrorist financing.

Already through the penultimate adaptation of the EU Money Laundering Directive (so-called “AML5 Directive“), cryptocurrencies moved massively into the focus of the directive makers and national legislators as well as supervisory authorities. We have compiled the money laundering directives for you in our FAQ. You can find them there under the question regarding the “legal basis”.

Cryptocurrencies were and are considered to pose a significant risk in the area of money laundering due to the possibilities of largely anonymous transactions. The use cases and technical principles have meanwhile been penetrated by the regulatory authorities. Now follows the adaptation of the legal regulations.

International Legislators Also Make Trading More Difficult Through Proof of Source of Funds for Cryptocurrencies!

At the same time, the directives and legislators are currently tying in not only in the European Union, but intercontinental where cryptocurrencies are primarily introduced into the economic cycle: at crypto exchanges, brokers and other trading places. As a result, these very entities are now increasingly required not only to verify the identities of their users, but also to require proofs of source for their financial resources and cryptocurrencies.

With these proofs of source of funds, the owners of cryptocurrencies are supposed to prove that they do not originate from the commission of crimes. The proof of origin of funds is based on the following assumption.

Anyone who acquires cryptocurrencies legally will also be able to provide clear proof of this legal source.

The fact that this basic assumption may be plausible, however, does not mean that in numerous cases (especially in the field of cryptocurrencies!) there may not be considerable difficulties in providing proof. Without any blame on the part of the owners. On our page on proof of source of wealth for precious metals, we have listed possible difficulties in proving despite legal acquisition.

These difficulties can occur in a similar style with cryptocurrencies. And in numerous other cases. Due to the strong price increases of cryptocurrencies in recent years, significant assets can be at stake as a result, completely through no fault of their own. Because the demanding bodies may decide to block the accounts on which your cryptocurrencies are located. You then no longer have any access to your assets for the time being.

How the Well-Known Cryptocurrency Exchanges Deal With Proof of Soure of Funds

As many new cryptocurrencies have been created in recent years, so many new exchanges and trading venues have emerged where you can buy and sell cryptocurrencies. Crypto exchanges are headquartered all over the world, often surrounded by complex corporate structures that touch multiple jurisdictions around the world.

Because of this international diversity, the compliance policies of individual crypto exchanges also vary widely. It is significantly influenced by the legal requirements of the state in which the crypto exchange is headquartered. Equally, however, by the laws of those states in which it offers its services.

Despite different legal scopes, however, one thing is the same for all exchanges and trading venues: International regulatory pressure on crypto exchanges is currently growing significantly!

In recent months, numerous well-known exchanges where cryptocurrencies can be traded announced tightening of their own so-called KYC (“Know Your Customer“) policies. In some cases, proof of source of funds for cryptocurrencies is now required from customers.

The individual modalities of these verifications and proof of source of funds requirements introduced by crypto exchanges can vary widely. It is therefore becoming increasingly important for customers today to deal decisively with the terms and conditions of the crypto exchange whose service is to be used in advance.

First and foremost, the country in which the company is located is likely to play a role when dealing with the various providers. This is because the different jurisdictions have a significant influence on the verification requirements of the crypto exchanges.

Binance, Bitpanda and Kraken Handle the Proof of Source of Funds for Cryptocurrencies Very Differently!

For example, Binance, one of the largest crypto exchanges in the world, recently made it public that it subjects both new and existing users to a so-called intermediate verification. This process includes in particular the determination and verification of user identities. What sounds like a matter of course, especially for German customers, was in fact not common practice at Binance until now. As can be read at the link above, Binance was known for enabling largely anonymous trading of cryptocurrencies.

It is true that Binance does not currently require proof of source of funds for cryptocurrencies. However, given the international regulatory pressure, we believe this is only a matter of time. The crypto exchange’s constantly changing international headquarters no longer seems to be able to prevent this.

Stricter requirements, on the other hand, were introduced by the Austrian-based crypto exchange Bitpanda a few months ago. As described on our page on the legal situation in Austria concerning proof of source of funds, the Austrian Financial Market Money Laundering Act (“Finanzmarkt-Geldwäschegesetz“, FM-GwG) has also been tightened due to stricter EU directives. Bitpanda is therefore obliged to both verify user identities and require proof of origin of funds for cryptocurrencies and fiat money from customers. See our page on Bitpanda’s proof of origin of funds for more information on this.

Kraken, a crypto exchange governed by US law, handles its KYC policy yet again differently than the aforementioned providers. As described on our separate page, Kraken also requires proof of source of funds for cryptocurrencies and cash deposits. However, the crypto exchange has extended connecting factors in this regard. The proof of origin requirements for Kraken’s customers are based on the amount of annual income, among other things.

Banks and the Proof of Source of Funds Requirement for Cryptocurrencies?

Not only exchanges where Bitcoin and cryptocurrencies are traded require proof of source of funds. Banks are also confronted with the legal regulations in this regard when exceeding various limits. Thus, your own bank may ask you queries due to your activities with cryptocurrencies.

Banks were very skeptical about Bitcoin, especially in the first years when cryptocurrencies appeared. At that time, they did not ask for proof of funds source, but directly blocked the respective current account due to trading with cryptocurrencies.

Nowadays, an account block no longer has to be expected as a rule. However, banks do ask for proof of source of wealth – especially if someone receives larger sums of money by selling cryptocurrencies on their own account.

Bank Demands Proof of Source of Funds for Cryptos? That’s What There is to Know!

So, the bank may ask you about the source of funds. This means both where your cryptocurrencies came from and what money you originally used to purchase these coins.

At the request of the tax office, your bank will pass on this data to the respective inquiring tax office for proof. In this respect, it must be expected that your proof of source of funds could sometimes end up with your tax office.

If you do not comply with your bank’s request for proof of source of funds for the cryptos, this will probably be reported to the bank’s internal money laundering department. You may be contacted by your bank’s money laundering officer(s).

Even then, if you do not clarify the source of your cryptocurrencies and financial resources, you are likely to be reported to the relevant authority or even have your account blocked. We would like to point out that banks can usually terminate contracts unilaterally with immediate effect without giving any reasons. There is usually no real protection against account blocking in the form of account termination.

We have already shown how a proof of source of funds properly prepared for the bank can look on our page on possible evidence. It is not possible to refer to a specific template or a specific sample in a targeted manner.

Going to Online Forum for Proof of Source of Funds for Cryptocurrencies? Not A Good Idea!

If you want to inquire about proof of source of funds on a relevant forum for cryptocurrencies, you will come across countless forum threads. Unfortunately, there is no reliance in the postings and responses we have read in such forums.

First, the discussions in a forum are often of an outdated nature, i.e. they are based on a legal situation that is no longer current in this form. Secondly, literally everyone writes there – even without in-depth knowledge of the proof of source of funds.

Furthermore, many contributions in such a forum seem more like an exchange of wishes. Those affected report on their experiences with proof of source of funds for cryptocurrencies and give each other encouragement that this is “all not so bad” or that there is “such and such” simple solution. The reality is often different.

In the case of higher sums of money held and traded in the form of cryptocurrencies, affected parties should not make any mistakes regarding the obligation to provide proof. Therefore, it is not worthwhile to fight your way through ages-long threads in a forum, only to finally realize that no one quite likes or is able to give an authoritative answer.

At the end of this page you will find our advice on where and how to seek professional support instead of relying on a random forum.

How Do I Organize My Cryptocurrencies So That Proof of Source of Funds is Easy to Provide?

As already described in our “First Steps” section, proof of origin of funds is not a purely formal proof. Rather, it is principally about showing a specific asset history of you as a person. While this further reinforces the sense that the proof of source of funds is a sensitive intrusion into your privacy, it is not a formal proof.

However, you can also use this understanding to your advantage! After all, complying with the proof of source of funds requirement is precisely not just about an isolated document that you present. It is about providing an overall impression of your financial life. The more coherent and orderly this appears in the overall picture, the fewer queries you will receive regarding the transaction in question.

When compiling the documents, try to enter into the viewpoint of the examining office. The more comprehensible you make your evidence, the faster and less complicated the review of your documents can be. This not only pleases the clerks who check your documents. It also allows the topic of proof of source of wealth for cryptocurrencies to end faster for you than if you are asked several times to submit additional documents.

3 Tips for Making A Good Overall Impression When It Comes to Proof of Source of Funds for Cryptocurrencies

We give you 3 tips to take to heart when it comes to proof of source of funds for cryptocurrencies:

- Don’t view the proof of source of funds requirement as harassment. Do “your job” at this point. Even the demanding body has only been required to demand proof. Work together!

- Imagine you have to audit your own records. So make it easy for the auditing clerks!

- Maintain your data continuously if you trade cryptocurrencies. This will save you a mountain of work if you are ever asked to provide proof of funds.

As in other areas of life, a clear and logical structuring of your documents to be submitted contributes to a clean overall impression. When it comes to proof of source of funds for cryptocurrencies in particular, however, this can be quite challenging. Because due to the numerous providers of exchanges and wallets, coins are often “moved around a lot” without you having to worry about reconstructing these transactions later on.

Therefore, as of today at the latest, prepare yourself for the fact that you could one day find yourself in the situation of having to provide proof of source of funds for your cryptocurrencies! Depending on the situation, this may mean being able to prove the transaction history!

Data Tools Help With Proof of Source of Funds for Cryptocurrencies

Various tools exist that can help you prepare your records, or even do it completely for you. It is like with all tools that process data: The cleaner and more regular you feed your data, the better the result will be!

One of the most well-known and proven tools is Cointracking. The platform structures and analyzes all transactions with cryptocurrencies that you enter there. This is made relatively easy for you through export and import functions. You can extract your transaction data on any major crypto exchange in Excel form, for example, and then import it into Cointracking. This avoids manual typing.

Cointracking is not a mundane tool, but is suitable for beginners and professionals alike. Your account is free as long as you don’t manage several thousand transactions there. Admittedly, it takes some time to get used to it. Invest that time and familiarize yourself with the interface. Then, providing proof of source of funds for your cryptocurrencies can end up being a breeze. After all, you can easily export your transaction history in the end in a clear format!

Classic Ways to Provide Proof of Source of Funds for Cryptocurrencies

Another way to prove the legitimate source of your coins is to take screenshots of your account on other exchanges. This is especially useful if you only have a small number of transactions to prove. The method is time-saving in this case, as you do not have to deal with additional tools. However, take the above tips to heart here as well! Make the screenshots in such a way that the reviewing clerks can understand and match what they see. It is best to include explanatory notes.

If, in addition to a proof of source of funds for your cryptocurrencies, you are also concerned with the origin of your money, it can be useful to compile a document package that tells the story of your money. You can use it to prove a wide variety of sources, such as inheritances, lottery winnings or capital gains also investments. But keep in mind: Your money mixes up! That is your advantage. With an extensive lottery win, for example, you will be able to prove any source of your financial means forever, without having to disclose further parts of your financial life. You may be quite strategic here if your privacy is important to you!

Proof of Source of Funds for Cryptocurrencies In the Case of Privately Purchased Coins

Account statements from both your bank and your exchange or broker can also serve as legitimate proof of the source of your cryptocurrencies. This is especially true in those cases where you bought cryptocurrencies from a private individual or sold one. Often in these situations, a clean purchase contract is missing, so a bank statement is almost the only way to prove it.

Especially in the situation of buying or selling cryptocurrencies between private individuals – which is basically completely unproblematic! – there may be problems later in proving the source of the coins. We have gathered for you more ideas for proof of source of funds that can be provided in these situations but are quite unknown so far, such as witness statements. While you’re at it, take a look at our section on possible evidence.

In Case of False Information: Report Suspicions to the Supervisory Authority!

The fact that you should make every effort when compiling your verification documents is also proven elsewhere. In the situation that you are supposed to provide proof of the source of funds to a crypto exchange, for example, it is usually a matter of carrying out transactions that are temporarily blocked until you provide the proof. This can be burdensome enough as it is, because often the demand for proof of source is accompanied by a block on your account with the exchange. Your assets, whether fiat money or cryptocurrencies, are temporarily frozen!

So these cases play out purely between you and the entity demanding the proof. However, if incomplete and thus misleading, or even deliberately false proof documents are submitted, other authorities may also become involved.

Please note: Crypto exchanges as well as brokers that are subject to European money laundering regulations are obliged to report suspicious cases to supervisory authorities!

As a user of the crypto exchange or broker, you will not be able to predict when such a suspicious case will occur. There are increasing reports that suspicious activity reports are sent too early rather than too late. This is because crypto exchanges, brokers and banks, for their part, are concerned that if they fail to file SARs, they will be sanctioned by regulators for violating money laundering regulations.

Please be aware that such a SAR refers to the criminal offense of money laundering and it is not a trivial offense!

Proof of Source of Funds, Cryptos and Tax Office – A “Lethal” Combination?

Cryptocurrency exchanges and brokers can not only pass on your data to the supervisory authorities for money laundering. If there are corresponding indications, they have the right to report special incidents to the tax office. The tax office will be less concerned with violations of money laundering regulations than with possible unpaid taxes. We have set up a separate page for you on this topic about problems with the tax office with further information.

If the tax office finds evidence that tax obligations may have been violated, it may order an overall review of the tax matters related to you. In simple terms, the tax office will check whether you have fully complied with your tax obligations in recent years.

It becomes clear: Any “shenanigans” in proving the source of your assets should therefore be refrained from. Not only in order to achieve a satisfactory result as quickly as possible together with the demanding authority. But also to avoid the involvement of other authorities.

Therefore, please read the following question and answer section carefully.

Important Q&A about the proof of source of funds for cryptocurrencies

Can't I just claim "anything" when proving the source of funds?

Certainly not. The requesting agencies are trained on money laundering prevention and in legal matters. Tangible proof of origin for your cryptos is required. Anyone who provides false information in the proof of origin of funds will be blocked.

I have lost the proofs to my cryptos - What to do?

This does not have to be a disaster. Proofs of source can be "recovered" pragmatically or, in a pinch, legally.

For example, you may be missing important bank statements or salary slips. However, these documents can usually be recovered - although often not free of charge.

How do I deal with absolute chaos because of countless transactions?

Often, those affected perceive their own asset situation and their "history of money" to be much more chaotic than it actually is.

Nevertheless, there are cases in which it is actually very difficult to still bring order to the asset flows regarding cryptocurrencies. In such cases, it is advisable to seek professional support for the proof of origin of funds.

What if I don't want to provide proof of source of funds for my cryptocurrencies?

Many people who are intensively involved with Bitcoin and other cryptos are of the opinion that they are allowed to carry out transactions anonymously and that the state cannot or should not be able to change anything about this. As an opinion, this is perfectly permissible. However, the respective states see it differently.

They do not have to provide proof of origin. There is no requirement for proof of source of funds. The question is rather: what do you do then? Because the largest exchanges that trade cryptos will simply prohibit you from continuing to trade there without a furnished proof of origin requirement.

You will end up with cryptocurrencies that you can no longer exchange for euros, dollars or other currencies. In some cases, not even against other cryptocurrencies.

Who is "worse" at proof of source of funds - crypto exchanges or banks?

We cannot see any differences from our experience. However, banks usually know their customers better than exchanges, since the bank has access to account movements over the last few years.

In addition, banks are likely to have people in charge of the source of funds who are trained accordingly. To what extent this applies equally to relatively new crypto exchanges, we cannot assess.

I am accused of money laundering and/or tax evasion - What to do?

In case of such allegations - no matter if they are true or not - an experienced lawyer should be consulted immediately. Your lawyer should be specialized in cryptocurrencies.

Special Knowledge About the Identity of Cryptocurrencies (Cause of the Proof Obligation?)

We have already presented the legal regulations on the proof of source of funds for cryptocurrencies above. However, in addition to the legal aspects, there are also technical reasons why the proof requirement applies to Bitcoin and other cryptocurrencies in particular.

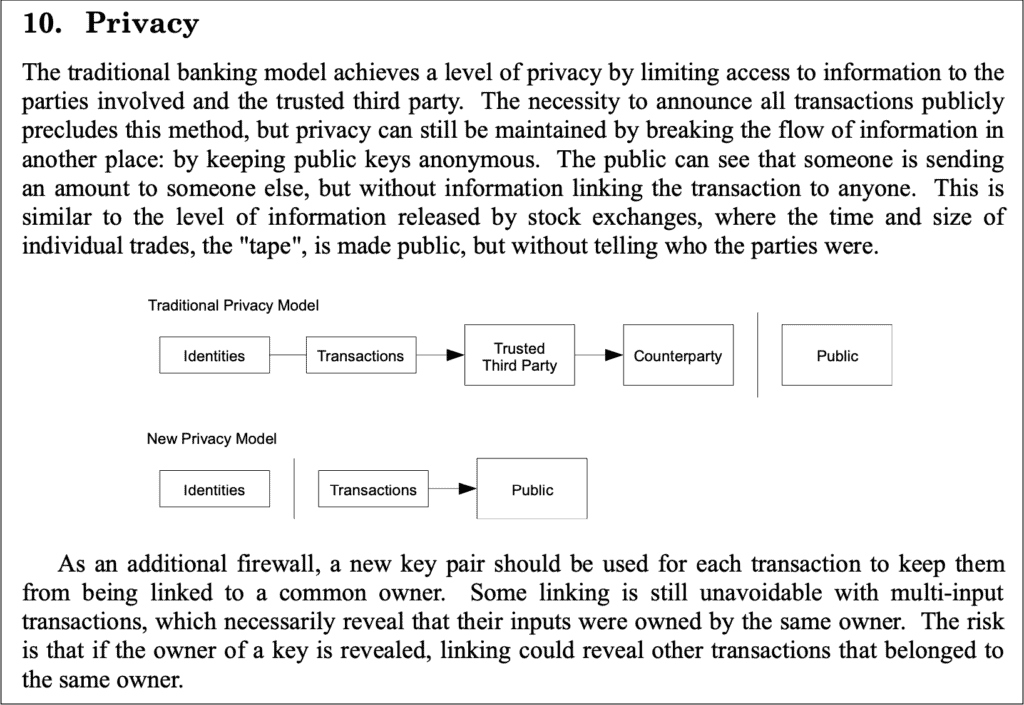

As can be seen from the Bitcoin Whitepaper, there is a big difference between identities in Bitcoin compared to identities in a bank transaction (subsection 10 – Privacy):

Pay attention to the description of the identities in the two charts “Traditional Privacy Model” and “New Privacy Model“. Here, Satoshi Nakamoto, the inventor of Bitcoin, has pointed out that identity is linked to individual assets in bank transactions.

Therefore, in bank transfers, identity is necessarily connected to the transaction and is only protected by the bank not disclosing the identity of the customer to the outside world (bank secrecy). With Bitcoin, however, this is different.

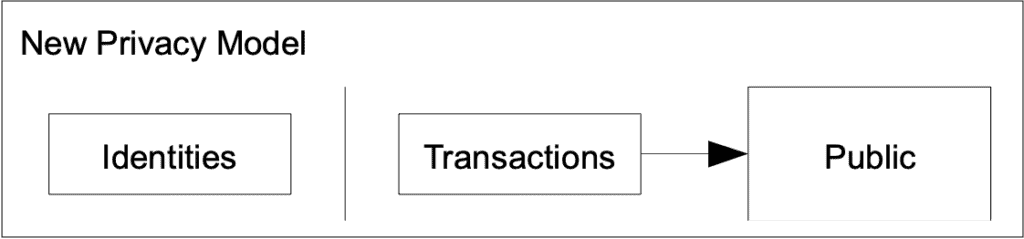

Bitcoin and Other Cryptos Protect Identity

According to the Bitcoin whitepaper, the identity is “firewalled”, i.e. protected by a firewall. A transaction with Bitcoin does not contain an identity, as seen in “New Privacy Model”. However, the transaction is publicly viewable, unlike bank transfers:

It is due to this technical circumstance that the legislators ultimately allow proof of the source of funds to be demanded for the prevention of money laundering and other criminal activities. Only in this way can the identity behind transactions with cryptos and the “history of the money” of persons involved be determined in a target-oriented manner.

The obligation to provide proof therefore has its actual source not in the purely legal, but in the technical. This applies similarly to all other cryptocurrencies, since almost all cryptocurrencies have implemented the same privacy model as Bitcoin (in some cases even more strictly).

What to Do If I Don’t Have Any Proof of Origin of Funds for Cryptocurrencies?

If you think you do not have any proof of source of your cryptocurrencies, the case must be examined intensively. This is because, in principle, there is always proof of the source of funds of assets. The only question is whether the proof will be accepted by the requesting authorities.

What do we mean by this? As we have already mentioned in our page on evidence for proof of source of funds, in case of doubt – i.e. if no other evidence can be provided – witness statements are a means of choice. In court, a witness statement is a weighty piece of evidence, regardless of the facts of the case.

Often, it also helps to provide proof of the source of funds in an indirect manner. If a specific asset or an individual movement of assets cannot be documented without gaps, there is no alternative but to cite the “whole story of your money”. Here, it is crucial to provide an overall impression that suggests that your assets probably have a legitimate source.

With cryptos, the burden of proof is sometimes stricter than with cash deposits or account transfers. Nevertheless, in the vast majority of cases, proof of source can be convincingly achieved.

Who Will Help Me If I Have Problems With the Proof of Source of Wealth for Cryptocurrencies?

Professional support on proof of funds source for cryptocurrencies is available from specialized lawyers, notaries, tax advisors and asset managers.

In difficult cases, going to a specialized lawyer is probably unavoidable, as notaries, tax advisors and asset managers may be able to recover or prove certain documents for you, but legal argumentation is still likely to be necessary.

When choosing your lawyer, make sure that he or she has relevant experience in dealing with cryptocurrencies per se, and specifically with proof of source of funds in cryptos.

Tips for dealing with a lawyer before you give the mandate:

- ask your lawyer if he or she has handled cases on proof of funds in bitcoin and other cryptos before

- inquire openly and honestly with the attorney about how successful the attorney has been in bringing these cases to a close

- get a lump sum quote for the entire case handling so that you can calculate with confidence

- make sure that your lawyer is actually interested in your proof of funds and does not just “blindly” forward documents for you

- Published: November 20, 2021

- Latest Update: March 24, 2022